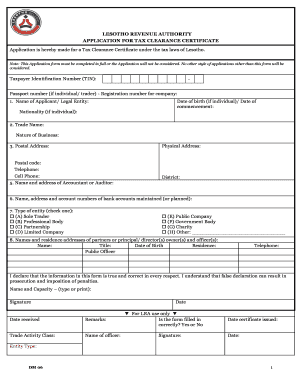

Application For Tax Clearance Certificate | A clearance certificate application form should be completed and lodged by australian resident vendors who don't wish to have an amount withheld by purchasers. A tax clearance expires every 90 days. A tax clearance is required by the secretary of state if a corporation's charter is administratively dissolved and the corporation wishes to be reinstated, or if the corporation is filing articles of voluntary dissolution, withdrawal, termination, or merger. A tax clearance certificate is a document which the south african revenue services (sars) issues with regards to the person's tax affairs. It certifies that a business or individual has met their tax obligations as of a certain date.

The relative application form may be acquired from any branch of district tax office and may be submitted through multiple sources such as submitting via email or online internet services. What is a tax clearance certificate? A tax clearance certificate verifies the entity satisfied all tax obligations due to the commonwealth, including taxes, interest, penalties, fees, charges and any other liabilities. A tax clearance is also required for a financial closing or sale of a business. A tax clearance expires every 90 days.

A tax clearance certificate is a document which the south african revenue services (sars) issues with regards to the person's tax affairs. A tax clearance certificate is confirmation from revenue that an applicant's tax affairs are in order. Pa department of revenue subject: This can also be used and is required for tender applications and "good standing" in terms of foreign investment and for emigration purposes. Applicants are responsible for submitting a valid certificate with all other application materials to the hiring agency. A tax clearance is usually required by businesses for a tender or to render a particular service. The irs also issues tax clearance certificates in certain situations, such as applications for. A tax clearance certificate verifies the entity satisfied all tax obligations due to the commonwealth, including taxes, interest, penalties, fees, charges and any other liabilities. A tax clearance expires every 90 days. It certifies that a business or individual has met their tax obligations as of a certain date. The entity that has legal title to the asset, is the entity required to obtain a clearance certificate for foreign resident capital gains withholding purposes. A tax clearance is a comprehensive tax account review to determine and ensure that an individual's account is compliant with all primary kansas tax laws. Reason for tax clearance request:

A tax clearance certificate verifies the entity satisfied all tax obligations due to the commonwealth, including taxes, interest, penalties, fees, charges and any other liabilities. A person may apply for. A clearance certificate application form should be completed and lodged by australian resident vendors who don't wish to have an amount withheld by purchasers. A tax clearance certificate is a document which the south african revenue services (sars) issues with regards to the person's tax affairs. If you need assistance with.

A person may apply for. A tax clearance is usually required by businesses for a tender or to render a particular service. Obtain the clearance certificate before you file the. Pa department of revenue subject: The irs also issues tax clearance certificates in certain situations, such as applications for. This can also be used and is required for tender applications and "good standing" in terms of foreign investment and for emigration purposes. Applicants are responsible for submitting a valid certificate with all other application materials to the hiring agency. A tax clearance is a comprehensive tax account review to determine and ensure that an individual's account is compliant with all primary kansas tax laws. A tax clearance certificate is confirmation from revenue that an applicant's tax affairs are in order. The entity that has legal title to the asset, is the entity required to obtain a clearance certificate for foreign resident capital gains withholding purposes. A tax clearance is required by the secretary of state if a corporation's charter is administratively dissolved and the corporation wishes to be reinstated, or if the corporation is filing articles of voluntary dissolution, withdrawal, termination, or merger. It certifies that a business or individual has met their tax obligations as of a certain date. What is a tax clearance certificate?

If you need assistance with. Dept of administration bid submission university of kansas contract state employment buying/selling business local government bid submission fort hays state's university contract lottery grant/loan application license renewal abc liquor license vehicle dealer other A tax clearance is a comprehensive tax account review to determine and ensure that an individual's account is compliant with all primary kansas tax laws. The entity that has legal title to the asset, is the entity required to obtain a clearance certificate for foreign resident capital gains withholding purposes. A tax clearance is also required for a financial closing or sale of a business.

A clearance certificate application form should be completed and lodged by australian resident vendors who don't wish to have an amount withheld by purchasers. Pa department of revenue subject: It certifies that a business or individual has met their tax obligations as of a certain date. A person may apply for. Obtain the clearance certificate before you file the. A tax clearance is also required for a financial closing or sale of a business. The irs also issues tax clearance certificates in certain situations, such as applications for. If you need assistance with. A tax clearance expires every 90 days. The entity that has legal title to the asset, is the entity required to obtain a clearance certificate for foreign resident capital gains withholding purposes. A tax clearance is required by the secretary of state if a corporation's charter is administratively dissolved and the corporation wishes to be reinstated, or if the corporation is filing articles of voluntary dissolution, withdrawal, termination, or merger. What is a tax clearance certificate? Reason for tax clearance request:

Application For Tax Clearance Certificate: A tax clearance is usually required by businesses for a tender or to render a particular service.